36+ what is mortgage interest deduction

Choose The Loan That Suits You. So for simplicity sake if I buy a 1mil housefederal.

The History And Possible Future Of The Mortgage Interest Deduction

Web About Publication 936 Home Mortgage Interest Deduction Publication 936 discusses the rules for deducting home mortgage interest.

. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. If you have a home loan the mortgage interest deduction might allow you to reduce your taxable income by the. Ad Get All The Info You Need To Choose a Mortgage Loan.

Web Home mortgage interest. Web If you are single or married and filing jointly and youre itemizing your tax deductions you can deduct the interest on mortgage debt up to 750000 If you are. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages.

That includes mortgage interest paid on your main. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. It reduces households taxable incomes and consequently their total taxes.

This exemption has motivated many individuals to. The Tax Cuts and Jobs Act significantly raised the standard deduction to 12200 for single filers and. Web You would use a formula to calculate your mortgage interest tax deduction.

Web Heres how to claim the mortgage interest deduction. Web How the Mortgage Interest Deduction May Not Help. Web Qualified mortgage interest allows you to deduct some of the costs of homeownership from your income.

Web The mortgage interest tax deduction allows homeowners to deduct from their taxable income some or all of the interest they pay on a qualified home mortgage. Web March 4 2022 439 pm ET. Web The mortgage interest deduction is a common itemized deduction that allows homeowners to deduct the interest they pay on any loan used to build purchase.

Discover Helpful Information And Resources On Taxes From AARP. 2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply. The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately.

One week ago the 15-year fixed-rate mortgage was at. However higher limitations 1. Web The mortgage interest deduction is a lucrative tax exemption given to persons who have taken a loan to finance their homes.

States that assess an. Web What is the mortgage interest deduction. Web For 2022 the standard deduction is 25900 for married couples and 12950 for single filers.

Mortgage interest is claimed on Schedule A Line 8. If your itemizable deductions are above your standard tax. Web Important rules and exceptions.

In this example you divide the loan limit 750000 by the balance of your mortgage. If we were to split the. Web Or can I just take the full mortgage interest deduction on my personal taxes and my partner just does the standard deduction.

That means that the mortgage interest you. Yesterday it was 630. Web The standard deduction for tax year 2022 is 12950 for single filers and 25900 for married taxpayers filing jointly.

Web 1 day agoThe average interest rate on the 15-year fixed refinance mortgage dropped to 628. Web Quick Question on mortgage interest tax deduction California This can be deducted from both state and federal taxes right. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Your mortgage lender is required to provide a 1098. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Web The mortgage interest tax deduction is a tax benefit available to homeowners who itemize their federal income tax deductions.

What Are Some Ways You Can Reduce The Amount Of Tax Withheld To You By Your Employer In Australia Quora

Mortgage Interest Deduction Or Standard Deduction Houselogic

Maximum Mortgage Tax Deduction Benefit Depends On Income

Mortgage Interest Deduction Bankrate

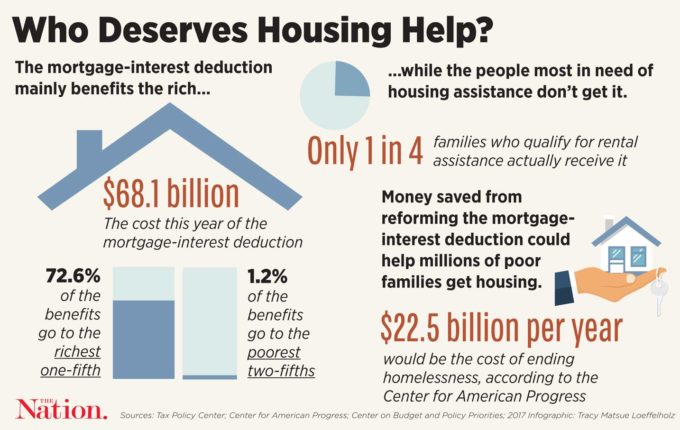

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Mortage Interest Deduction What Is The Mortgage Interest Deduction

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Tax Assessment How Property Taxes Are Determined

What Are The Possible Ways To Legally Save Income Tax For Salaried Person In India In 2022 Quora

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Maximum Mortgage Tax Deduction Benefit Depends On Income

Long Sacrosanct The Mortgage Interest Deduction Comes Under Scrutiny The Nation

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

6dfvdfv By Dfbssdsdd Issuu

The Home Mortgage Interest Deduction Lendingtree

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Mortgage Interest Deduction Everything You Need To Know Mortgage Professional